Financial reports are actually pretty magical. If you’re rolling your eyes reading this, please hear me out. Your financial reports offer you all the data you need to grow your business, but many business owners dread reviewing them. Why? Well, if you print out your financial reporting from whatever software you’re using, it can seem like a lot to muddle through by yourself. The data is there, but you need to review and analyze it to find the magic.

What should you focus on each month and why? How will knowing this information help your business grow - even in tough times? I would be happy to answer all of this and more in the video and explanation below. Let’s dive in so I can show you the magic of your financial reports.

What to Look for in Your Small Business Financial Reports

These are the main objectives that I go through with my clients each month when we review their financial reporting and analysis.

1. Cash Forecasting

This is all about where your dollars are going and what’s left in the bank. Look at your average monthly expenses from a high-level view to watch for any spikes. It’s important to review your current cash flow for a few reasons. You can watch where your current balance is (how much you have in the bank), forecast what you expect to spend, and you now have the opportunity to catch any low points and adjust.

2. Income

This is the thermometer for your business’s health and growth. Here, you need to watch the progress towards your annual business income goal. You can look at how much income you brought in as well as which lines of business were your most profitable. You might be surprised to find which lines of business actually resulted in income and realize you need to focus your efforts there.

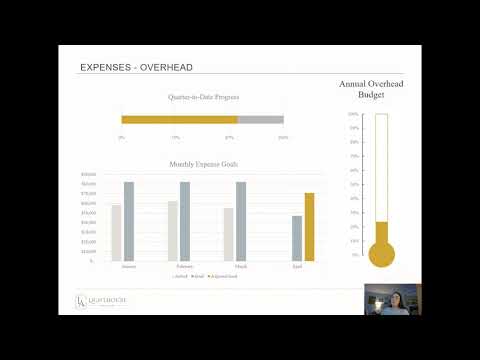

3. Expenses

Reviewing your monthly business expenses doesn’t have to be scary. Watch how much you’re spending, where, and then ask questions as to why. Overhead expenses are important to watch and make any changes to help your bottom line throughout the year. This creates the ability to monitor any ebbs and flows in your expenses per month, so you can plan better in the future.

Find Your Trusted Financial Partner

I’m sure by now you’re convinced of your financial reports’ magical qualities, but if you’re still hesitant to start printing them out and looking through them yourself, I understand. It’s much easier to learn from your reports and apply those insights to your business if you’re guided by a professional.

Many clients share with me that walking through their financial reports together is so incredibly valuable for their business. If you think I could be a good fit for you, please click here to schedule a 45-minute introductory consultation. This free call helps us get to know each other and see if there’s an opportunity to work together.