Proactive Preparedness: The Importance of Emergency Planning for Entrepreneurs

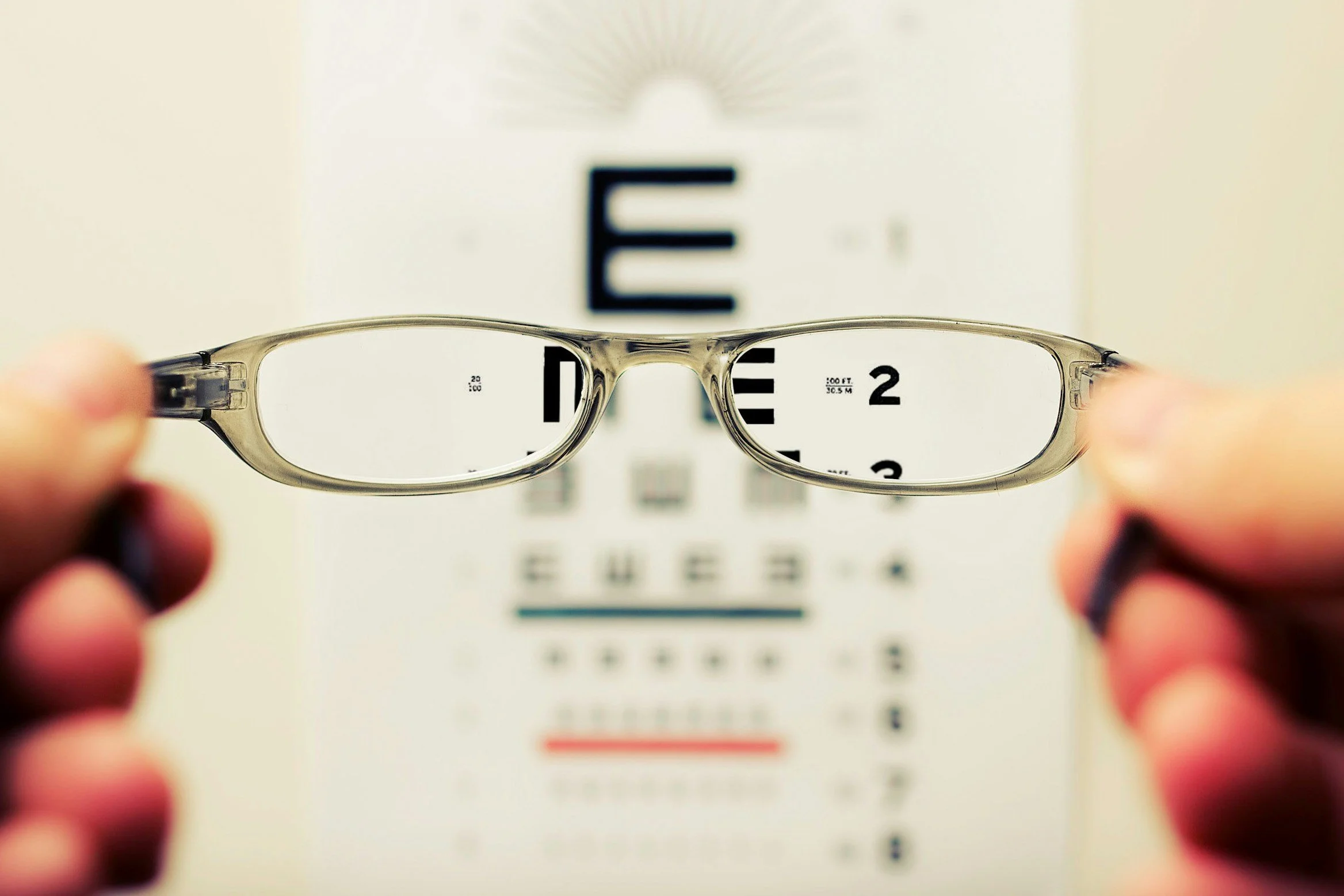

In March, an unexpected health diagnosis turned my world upside-down. Just a couple months into maternity leave, I was diagnosed with MOG Antibody Disease (MOGAD), a relatively new term in the field of neurology. This condition primarily targets the optic nerve and for me, resulted in bilateral optic neuritis. I went from having full vision to complete blindness in a couple of days. The sudden onset of this disease was not just a personal crisis but a pivotal moment for my business.

Despite the challenges, this experience highlighted the importance of having robust emergency processes in place. Fortunately, I had taken some preemptive steps which helped keep the operations running smoothly even during my unexpected absence. But how many business owners and solopreneurs don't have that in place? You never know what could happen, and it's crucial to setup those processes in the event of an emergency or unexpected change!

In this blog post, I’m sharing my top 5 strategies and insights into dealing with this unforeseen situation to hopefully help you start thinking about your own emergency planning.

Emergency Preparedness Strategies & Insights

1. Delegate Responsibilities

I had a trustworthy employee on my team who, upon my diagnosis, took the initiative to notify all of our clients about my sudden health issue and the potential delays it might cause. This transparent communication helped in maintaining trust and understanding from our clients, ensuring the business could run as smoothly as possible in my absence.

2. Automate Where Possible

I had already set up automated systems for most recurring invoices and payments. Automation ensured that despite my inability to fully participate in day-to-day operations, financial transactions and client billing continued without interruption, safeguarding our cash flow during a critical time.

3. Prepare a Comprehensive Business Continuity Plan

My experience underlined the importance of having a detailed business continuity plan (BCP). A good BCP not only covers who handles operations in your absence but also details processes for financial management, client communication, and other critical business functions. It ensures that your business can withstand not just personal emergencies but other unexpected events such as natural disasters or economic downturns.

4. Invest in Training Your Team (Or A Trusted Friend!)

Training isn’t just about improving skills; it's also about preparing your team to handle the business in your absence. Regular training sessions can help your employees (or a trusted friend, colleague or family member, if you are a soloprenuer) handle a range of functions, giving them the confidence to make decisions when you cannot.

5. Review and Update Your Plan Regularly

Emergency planning is not a one-time task. Regular reviews and updates to your emergency plans, in alignment with changing personal circumstances and business growth, ensure that the plan remains effective and relevant.

Navigating Business with Proactive Preparedness

My journey with MOGAD was an eye-opener about many things, particularly about how unpredictably life can change and how your business can be impacted. The proactive steps I had taken helped prevent my business from becoming a casualty of my health crisis. This reinforces the message that in business, just as in health, prevention is better than cure.

To all business owners out there, take this as a reminder: prepare your business for emergencies before they happen, because you never know what tomorrow may hold. Keep your business strong, resilient, and ready to face the unexpected.

Start your journey to financial success by scheduling your free consultation with Lighthouse Advisory today. Let us be your guiding light in budgeting, financial planning and proactive preparedness! Please click here to schedule your consult.